Consumers Surveys

UrbiStat specialized retail research team has developed ad-hoc consumer surveys for nearly 20 years. Such accumulated experience and expertise enable substantial benchmarking of output results leading to only relevant insights for retail specialists.

Consumer surveys are usually deployed in single retail stores, shopping centres or within catchment areas and are fully coordinated by UrbiStat for investors or property managers upon request.

UrbiStat only woks with certified agencies that guarantee high quality standards in data collection.<br>

Each request for consumer surveys is turned into a specific research project divided in five phases:

KICKOFF

workshop to define the research objectives (deep and detailed)

PLANNING

selection of the most suitable agency for data collection; define the methodology

ORGANIZING

share and agree research material; finalize calendar

EXECUTING

data collection performed by the agency

REPORTING

analysis and reporting done in-house by UrbiStat retail research team

In general, the objectives of consumer surveys relate to:

- define/investigate the target audience (socio demographics profile)

- assess consumers taste and preferences towards shopping activities (online, offline, omnichanel)

- evaluate operations (opening, cleaning, courtesy, parking, lighting, food-court, restrooms, services, music,

accesses, safety and several additional attributes)

- evaluate and position the tenant mix (only for shopping centres)

- investigate the competition (who, where, when, how much, for what, drivers, breaks)

- assess the shopping experience

- test marketing / promo campaign valuation / website usage

Catchment Area Analysis

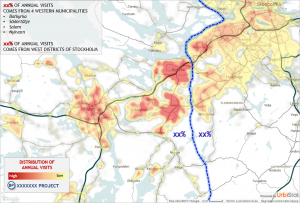

Catchment areas are not the same as isochrones and this concept is well understood at UrbiStat where sophisticated geomarketing tools allow the representation (heat maps) of where annual visits are generated and the characterization (thematic maps) of residents within a certain territory.

Overlapping areas and geo coding enable the perfect geographical assessment of a portfolio or the analysis of it performance (market shares, penetration, loyalty).

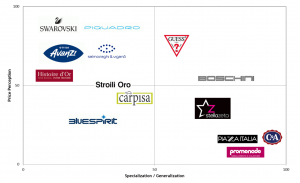

Tenant Mix Appraisal

The tenant mix assessment is performed for shopping centres taking advantage of the vast database owned and managed by UrbiStat that has brands categorized by average size, average sales per sqm, average rents per sqm, average effort rates, average pricing point and assortment.

The tenant mix appraisal allows property managers to benchmark sales and effort rates of brands present in their malls as well as to identify opportunities for reletting within merchandising categories or according to visitors’ socio demographic and economic profile.

We are here to Help You.

Urbistat studies support companies for business decisions, your goal is our goal.